Accounting software is a program or application that helps businesses keep track of their financial transactions. This type of software can range from simple bookkeeping software to more complex enterprise resource planning (ERP) systems.

Many accounting software programs are available online, and they can be used to manage all aspects of a business’s finances, including invoicing, tracking inventory, and generating financial reports.

There are many different types of accounting software programs available on the market today. Some programs are designed for specific industries, such as construction or retail, while others can be used by businesses of all types.

When choosing an accounting software program, it is important to consider the features that are most important to your business. For example, if you need a program that can handle complex financial transactions, you will want to choose an ERP system.

However, if you only need a simple bookkeeping program, there are many less expensive options available.

When choosing an accounting software program, it is also important to consider the scalability of the program. If you are a small business, you may not need all of the features offered by an ERP system.

However, if you are a growing business, you will want to choose a program that can grow with you. Many accounting software programs offer different levels of service, so you can choose the level that is right for your business.

There are many benefits to using accounting software. Perhaps the most important benefit is that it can help you save time. With all of your financial transactions in one place, you will no longer need to waste time searching for paper records or manually inputting data.

In addition, accounting software can help you avoid mistakes, such as incorrect calculations or entered data.

Here are details of the top accounting software we have listed in this article.

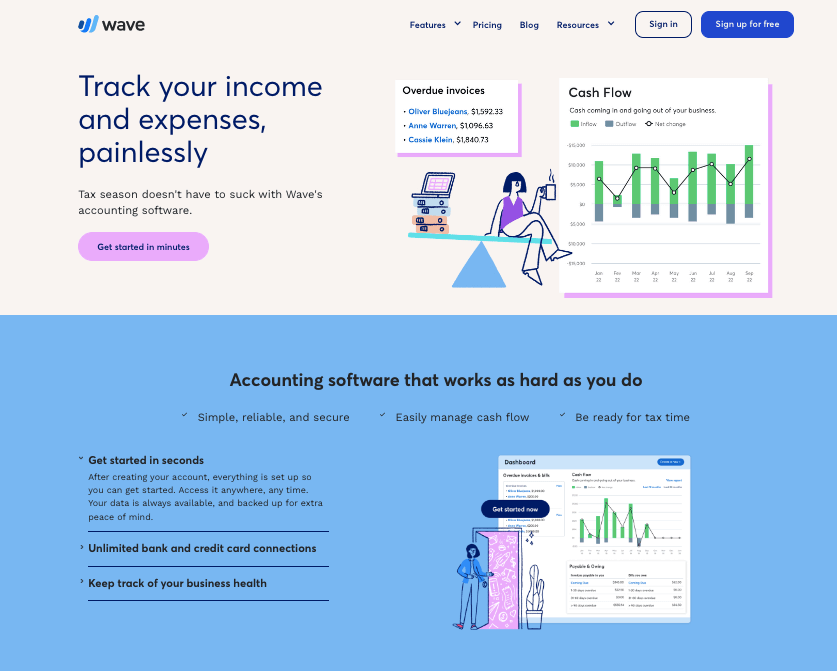

01. Wave

Wave is free accounting software that is perfect for small businesses. It offers invoicing, payments, and accounting features all in one platform. Wave is easy to use and can be up and running in minutes.

One of the best things about Wave is that it integrates with other business software so that you can manage all your business tasks in one place.

With Wave, you can connect an unlimited number of books and accounts, making it an excellent option for businesses with complex financial needs. It’s designed to be simple and easy to use so that you can get started quickly.

Moreover, Wave offers invoicing and receipt scanning tools that help you keep track of your expenses. The software also has a handy accounting feature that gives you an overview of your business finances.

Wave is free to use, so it’s ideal for small businesses and startups.

Wave features:

- Free to use-Easy

- Automatic bank reconciliation

- Double-entry accounting

- Expense tracking and categorization

- Receivables and payables management

- Tax preparation and filing

- Financial reporting

- Multi-currency support

- Wave Pay (online invoicing)

Pricing — Free

02. Intuit Quickbooks

QuickBooks is one of the most popular accounting software options on the market. It offers a wide range of features and is suitable for businesses of all sizes.

QuickBooks is easy to use and helps you manage your finances with ease. Regarding third-party integrations, QuickBooks integrates with a wide range of business software. It is an excellent option for businesses that want to manage all their tasks in one place.

Furthermore, QuickBooks offers invoice capturing, tracking expenses, and managing inventory. It also has a handy reporting feature that provides an overview of your business finances. QuickBooks is an excellent option for businesses of all sizes.

QuickBooks features:

- Track sales and expenses

- Stay organized and in control of your business finances

- Save time on accounting and bookkeeping tasks

- Get paid faster with online invoicing and payments

- Get insights to make better business decisions

- Grow your business with add-on solutions

Pricing — It starts from $20 per month

03. Freshbooks

Freshbooks offers intuitive and user-friendly accounting software that is perfect for small businesses and freelancers. It’s easy to use so that you can get started quickly. Freshbooks also offers several features to help you save time and stay organized.

For example, the software allows you to track your time, send invoices, and manage projects. Freshbooks also offers excellent customer support, so you can get help when needed.

Moreover, you can quickly integrate Freshbooks with other business software, such as Google Calendar and Zapier. It makes it easy to manage all your tasks.

Freshbooks offers a free trial, so you can try it before you buy. The client management system is sound, with a self-service portal and decent automation features.

Freshbooks Features:

- Automatic bank feed import and categorization

- Double-entry bookkeeping

- Invoicing and recurring payments

- Payment processing and tracking

- Estimates and proposals

- Expense tracking

- Time tracking

- Project management

- Reporting and analytics

Pricing — The price starts from $15 per month.

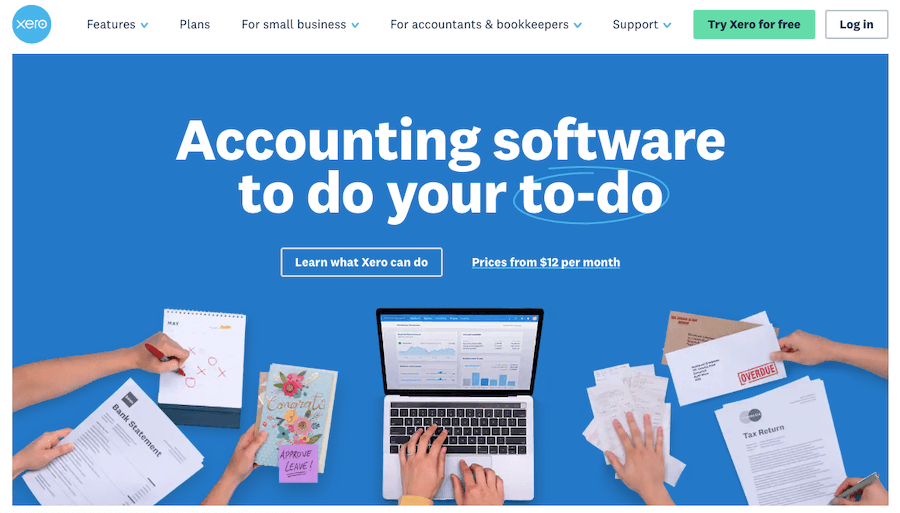

04. Xero

Xero is online accounting software that offers a wide range of customized features for businesses of all sizes. Xero also offers a mobile app to manage your finances on the go.

With Xero, you can simplify the overall payroll processing, which makes it an excellent choice for businesses with employees. The software also offers real-time tracking of inventory levels and automated bank reconciliation.

Xero integrates with over 700 third-party applications, so you can customize the software to fit your specific business needs. Moreover, Xero offers 24/7 customer support and a free trial, so you can try the software before you commit to it.

In addition, you can connect your multiple bank accounts and manage your finances in one place.

Xero features:

- Xero is cloud-based, so you can access your finances anywhere, anytime

- Automate tasks like invoicing, paying bills, and bank reconciliation

- Get real-time visibility into your cash flow to make better business decisions

- Collaborate with your accountant or bookkeeper in one place

Pricing — Price starts from $9 per month.

05. Zoho Books

Zoho Books is widely-used accounting software that offers a comprehensive set of features. It includes everything you need to manage your finances, from invoicing and payments to tracking expenses.

Zoho Books is easy to use, and you can be up and running in minutes. The software has a clean interface that is easy to navigate.

Zoho Books software also offers a wide range of reports to see how your business performs. Moreover, Zoho Books also offers an automation tool that helps you save time on repetitive tasks.

The software integrates with other Zoho products so that you can manage all your business needs in one place. Also, you get options to integrate timesheets, project management, and CRM software.

Zoho Books Features:

- Zoho Books can manage your finances, track your expenses, and do your bookkeeping.

- It is available in both a free and paid version, with the paid version offering more features.

- User-friendly interface and is suitable for small businesses and freelance professionals.

- It integrates with other Zoho products, such as Zoho Invoice, and offers a mobile app for Android and iOS devices.

- Generate invoices, track payments, and run reports.

- The software also includes features such as project tracking, time tracking, and inventory management.

- Zoho Books offers excellent customer support and has a detailed knowledge base.

Pricing — Price starts from $9 per month.

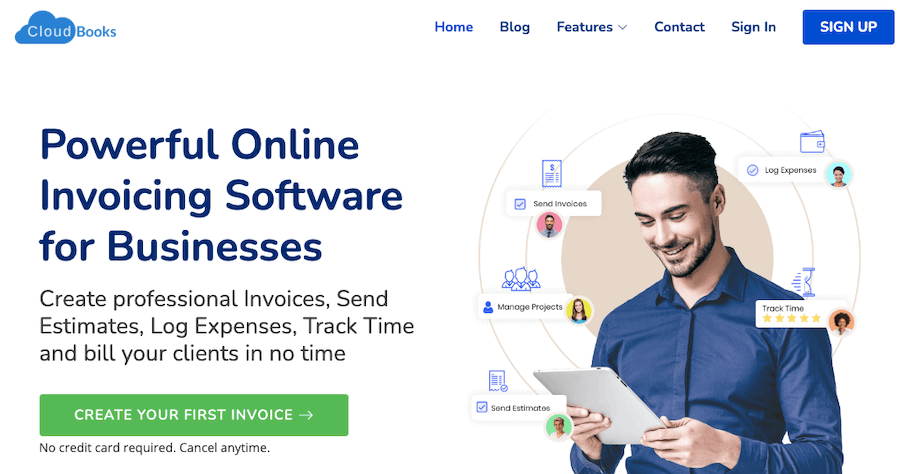

06. CloudBooks

CloudBooks is online accounting software that offers a wide range of features for businesses of all sizes. With CloudBooks, you can create invoices, manage expenses, track time, and run reports.

The software also offers a project management tool to help you keep track of your projects.

CloudBooks also has a time-tracking feature that allows you to track your time on each project. It is a great way to see where you’re spending the most time and find ways to improve your productivity.

CloudBooks is ideal for businesses that need to track time and expenses. The free CloudBooks subscription is available for one user, and if you have a bigger team, CloudBooks also offers premium plans.

CloudBooks features:

- Accounts Receivable

- Accounts Payable

- Aged Receivables Report

- Aged Payables Report

- Bank Reconciliation

- General Ledger

- Financial Statements (Profit & Loss, Balance Sheet)

Pricing — Pricing starts from $10 per month

07. ZipBooks

ZipBooks is accounting software that offers a free trial, so you can try it before you commit to a subscription. It’s designed for small businesses and has all the features you need to manage your finances.

With ZipBooks, you can create invoices, and manage expenses and your books. The software also has a handy project management feature to keep track of your projects and clients in one place. ZipBooks is easy to use and has a clean interface.

ZipBooks software is ideal for small businesses because it offers a free trial and has all the features you need to manage your finances. In addition, the software is easy to use and has a clean interface.

ZipBooks features:

- Track your income and expenses in one place

- See your business finances at a glance with convenient reports

- Easily invoice customers and get paid faster

- Say goodbye to data entry with automatic bank synchronization

Pricing — Free, paid plans start from $15 per month.

08. OneUp

OneUp is an all-in-one accounting and invoicing software that offers many features. If you’re looking for comprehensive inventory management, OneUp is an excellent option.

It also allows you to track your sales and expenses to see where your money is going. In addition, OneUp offers a free trial, so you can try it before you commit to a subscription.

Moreover, the overall management features work fast, saving you time. The software offers a wide range of integrations, so you can connect it to the other tools you use for your business. OneUp is also mobile-friendly, so that you can access it from anywhere.

OneUp features:

- Easily reconcile your books and get a clear picture of your business finances

- Generate professional invoices and track payments

- Get real-time insights into your cash flow

- Manage inventory, projects, and staff all in one place

- Connect to your bank account for seamless transactions

Pricing — The price starts from $19 per month.

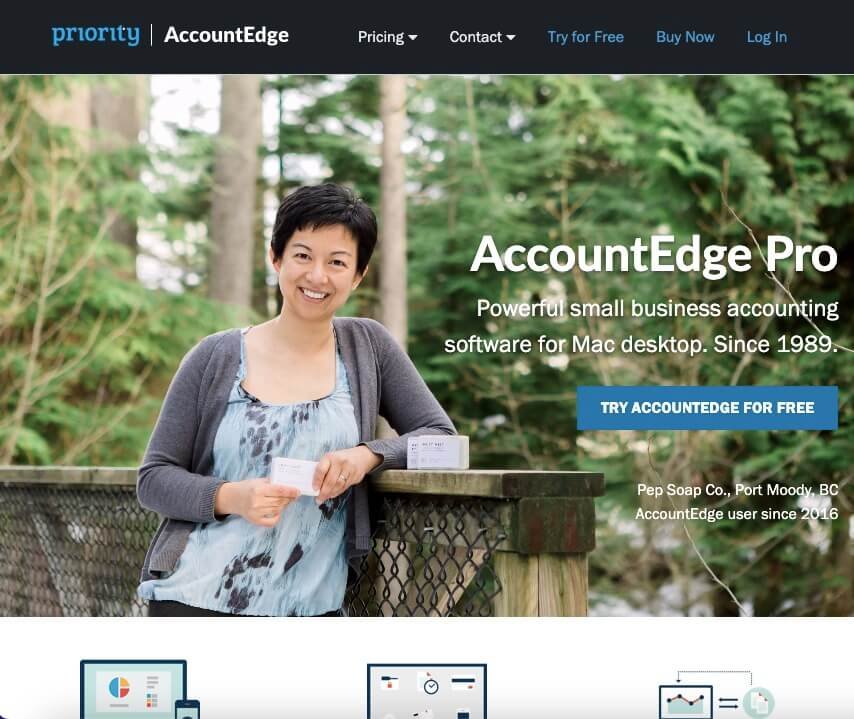

09. AccountEdge

AccountEdge is accounting software that offers invoice, inventory management, and tracking payments. It’s designed for small businesses and can be used on Mac or Windows.

AccountEdge also integrates with other business software so that you can manage all your tasks quickly. The software has an easy-to-use interface and offers a wide range of features.

With AccountEdge, you can create invoices, manage inventory, track payments, and more. AccountEdge is an excellent option for small businesses that need a comprehensive accounting solution. Moreover, you can also accept credit card payments from customers.

AccountEdge features:

- Keep track of money going in and out of your business

- Easily create and send invoices

- Track inventory, customers, and vendors

- Generate reports to help make better business decisions

- Seamlessly integrate with other business applications

- Get started quickly with free phone and email support

Pricing — The price starts from $499, a one-time installation fee.

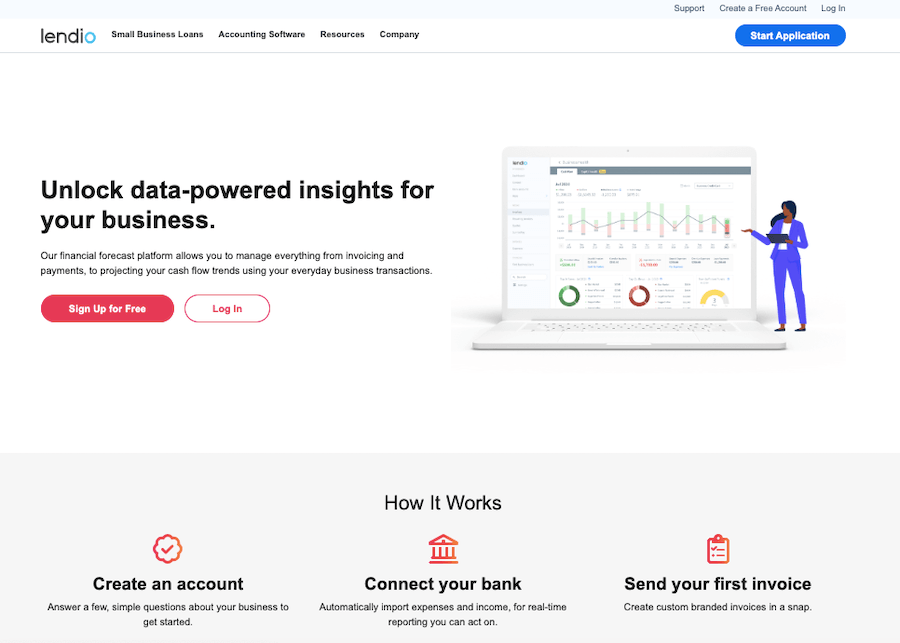

10. Lendio

Lendio is an invoicing and accounting software that offers a simple and easy-to-use interface. It’s perfect for small businesses and startups as it provides all the features you need to start quickly.

For example, Lendio offers you a detailed cash flow page that shows you where your money is going and what needs to be paid. You can also create and send invoices, track expenses, and manage your business finances all in one place.

Lendio also offers a handy mobile app to access your accounting software on the go. The software is free for up to three users, making it an excellent option for small businesses.

Lendio features:

- General Ledger

- Accounts Receivable

- Accounts Payable

- Bank Reconciliation

- Financial Statements

- Sales Tax Reporting

- Inventory Management

Pricing — The price starts from $19.99 per month

11. Sage

Sage is an all-in-one accounting software that offers invoicing, payments, and payroll features. Sage is designed for small businesses and startups. Sage is easy to use, and you can be up and running in minutes.

The software is cloud-based, so you can access it from anywhere. With Sage, you can connect an unlimited number of books and accounts, making it an excellent option for businesses with complex financial needs.

Moreover, Sage offers seamless collaboration features making it easier for you to work with your team. In addition, the software provides a full-fledged inventory management system that helps you keep track of your stock.

Sage features:

- Accounts receivable and accounts payable management

- Invoicing and quotes

- Inventory management

- Financial reporting

- Tax management

- Multi-currency support

- Customer relationship management

Pricing — The price starts from $10 per month

12. Kashoo

Kashoo is another excellent accounting software option for small businesses. It’s simple and offers all the necessary features to run your business finances.

For example, Kashoo has a double-entry bookkeeping system that helps you keep track of your income and expenses.

You can also create invoices and send them directly to your clients. In addition, Kashoo integrates with your bank account so you can track your transactions and see a real-time view of your finances.

Kashoo also offers a mobile app so you can manage your finances on the go. The software provides a free trial, so you can try it out before you commit to a subscription.

Kashoo features:

- Accounts payable and receivable

- Invoicing

- Budgeting

- Tracking expenses

- Creating financial reports

- Multi-currency support

Pricing — The price starts from $16.65 per month

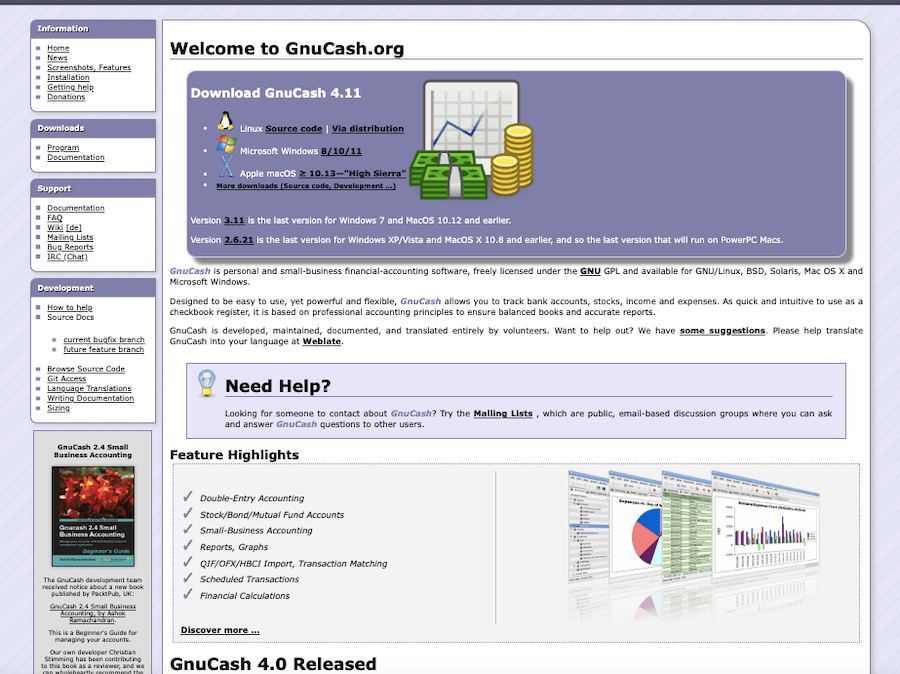

13. GnuCash

GnuCash is free and open-source software that brings a variety of features. It includes double-entry bookkeeping, bank account management, and invoicing.

GnuCash is an excellent option for small businesses and startups because it’s easy to use and free to download.

In addition, the software has a clean interface that is easy to navigate. GnuCash also offers a wide range of reports to track your business finances.

GnuCash is ideal for small businesses and startups because it’s easy to use and free to download. In addition, the software has a clean interface that is easy to navigate. GnuCash also offers a wide range of reports to track your business finances.

Moreover, the software integrates with other business software, making it an excellent option for businesses with complex financial needs.

GnuCash features:

- Double-Entry Accounting

- Stock/Bond/Mutual Fund Portfolios

- Small Business Accounting

- Online Banking and Bill Payment

- Check Printing

- Reports, Graphs, and Tax Preparation

Pricing — Free